Introduction

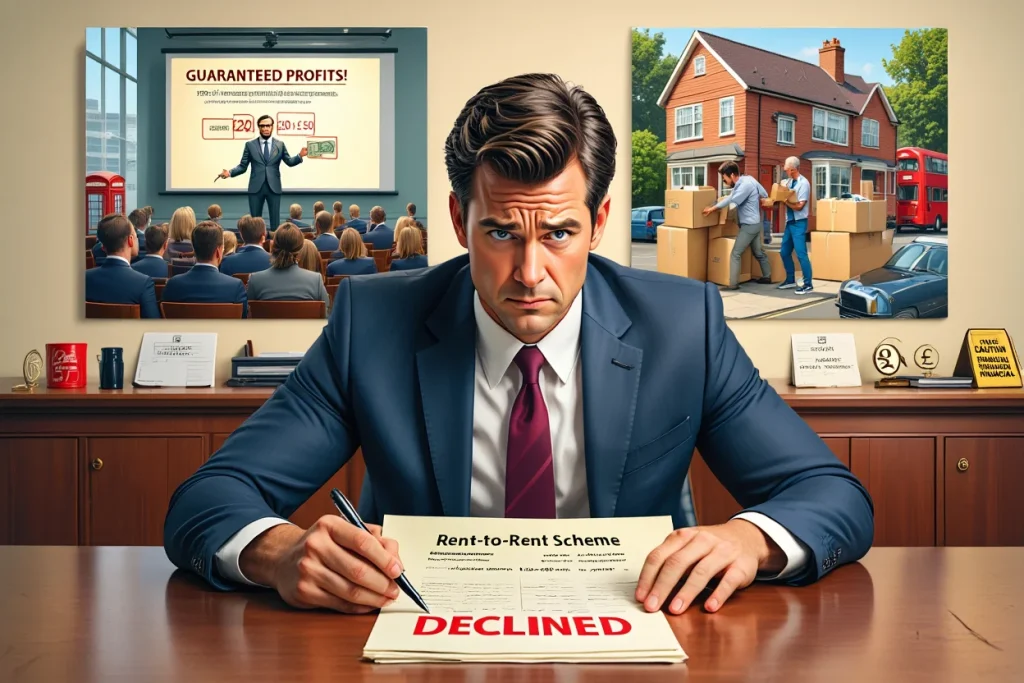

In recent years, the British property market has witnessed a surge in so-called “rent-to-rent” schemes, often marketed as a revolutionary approach to property investment requiring minimal capital outlay. This business model, commonly abbreviated as R2R, involves an individual or company renting a property from a landlord and subsequently subletting it to tenants at a higher rate, pocketing the difference as profit.

Whilst the concept may appear straightforward and potentially lucrative, there are significant concerns that merit careful consideration. This article aims to provide a comprehensive examination of the rent-to-rent model, highlighting the risks for both landlords and prospective rent-to-renters, particularly those who might be considering expensive training courses promising financial independence through this approach.

The Alluring Premise of Rent-to-Rent

The rent-to-rent model has gained popularity largely due to several attractive propositions:

Low Barrier to Entry

Perhaps the most compelling aspect of rent-to-rent is the minimal initial investment required. Unlike traditional property investment, which necessitates substantial deposits or outright purchases, rent-to-rent enables individuals with limited capital to participate in the property market.

Rapid Income Generation

Proponents of rent-to-rent highlight the potential for immediate cash flow. By securing a property at a lower rental rate and reletting it at a premium, practitioners can theoretically begin generating returns within weeks or months rather than the years often associated with capital appreciation in conventional property investment.

Scalability

The low financial threshold ostensibly allows practitioners to rapidly expand their portfolio, taking on multiple properties in a relatively short timeframe without the financial constraints associated with purchasing properties outright.

Practical Experience

For novices, rent-to-rent can provide valuable hands-on experience in property management, potentially serving as a stepping stone to more substantial property investments in the future.

The Concerning Reality Behind the Glossy Marketing

Despite these apparent advantages, the rent-to-rent model harbours numerous challenges and risks that are frequently understated or entirely omitted by those promoting expensive training courses.

Legal and Regulatory Complexities

Rent-to-rent arrangements must operate within strict legal parameters, including:

- Landlord Permissions: An alarming 99% of mortgage lenders explicitly prohibit subletting arrangements such as rent-to-rent. Attempting to circumvent this through semantic distinctions such as “corporate lets” or “commercial arrangements” is futile – lenders are well aware of these tactics and will not hesitate to call in mortgages when such breaches are discovered.

- Insurance Invalidation: Similarly, the vast majority of insurance providers will void policies upon discovering subletting arrangements, regardless of how they are characterized or labeled. This leaves both the property owner and the rent-to-renter exposed to catastrophic financial risk in the event of damage, fire, or other insurable incidents.

- Licensing Requirements: Particularly for Houses in Multiple Occupation (HMOs), specific licences are required, and failure to comply can result in severe penalties.

- Tenancy Legislation: Rent-to-renters must navigate complex tenancy laws, ensuring compliance with all statutory obligations.

Financial Vulnerability

The very circumstances that lead many individuals to pursue rent-to-rent—namely, insufficient capital for traditional property investment—often place them in precarious financial positions:

- Limited Financial Reserves: Operating with minimal capital means little financial buffer for unexpected expenses, vacant periods, or non-payment by tenants.

- Contractual Obligations: Rent-to-renters remain liable for payments to the original landlord irrespective of whether they successfully secure tenants or if those tenants remit payment.

- Asset Vulnerability: Without ownership of the property, rent-to-renters have no tangible asset to secure against losses or serve as collateral for potential legal disputes.

Operational Challenges

Many new entrants to rent-to-rent lack the requisite experience and professional training for effective property management:

- Regulatory Knowledge Gaps: As illustrated by cases where rent-to-renters were unaware of their legal obligation to test fire alarms in HMOs, many practitioners operate with dangerous knowledge deficits.

- Tenant Management Issues: Inexperienced operators frequently encounter difficulties managing tenant relationships, addressing maintenance issues promptly, and handling complaints effectively.

- Compliance Oversights: Without proper training, rent-to-renters may inadvertently breach regulatory requirements, exposing themselves to significant legal and financial risks.

Market Saturation and Landlord Wariness

The proliferation of rent-to-rent schemes has led to:

- Increased Competition: Finding viable opportunities has become increasingly challenging as more individuals pursue the same limited pool of suitable properties.

- Landlord Scepticism: Property owners and agents have grown increasingly wary of rent-to-rent proposals, recognising the associated risks and potential complications.

Business Continuity Risks

The rent-to-rent model inherently lacks security:

- Property Reclamation: Landlords can typically reclaim their property with relatively short notice, immediately terminating the rent-to-renter’s income stream.

- Limited Recourse: Those operating rent-to-rent schemes often lack the financial resources to pursue legal action if agreements are breached.

- Scaling Pitfalls: Rapid expansion without adequate operational infrastructure frequently leads to management deficiencies, cash flow problems, and ultimately, business failure.

The Uncomfortable Truth: Who Really Profits?

Perhaps the most concerning aspect of the rent-to-rent phenomenon is the ecosystem that has developed around it. A critical examination reveals that the primary beneficiaries are often not the participants in rent-to-rent schemes but rather those selling expensive training courses, seminars, and materials promising to reveal the “secrets” of rent-to-rent success.

The Training Industry Paradox

The proliferation of rent-to-rent training programmes raises several pertinent questions:

- Incentive Misalignment: If rent-to-rent were genuinely as profitable as claimed, why would successful practitioners divert their attention to selling courses rather than expanding their own rent-to-rent operations?

- Low-Value Instruction: Many courses provide information that is readily available through legitimate property organisations at a fraction of the cost.

- Success Rate Transparency: There is a notable absence of independently verified data regarding the proportion of course graduates who establish sustainable rent-to-rent businesses.

The Marketing Manipulation

The marketing of rent-to-rent training frequently employs psychological triggers to target vulnerable individuals:

- Financial Desperation Appeal: Courses are often marketed specifically to those in financial difficulty, presenting rent-to-rent as a “no money down” solution to their problems.

- Lifestyle Promises: Promotion materials typically feature luxury lifestyles, suggesting that rent-to-rent can deliver financial independence and material wealth with minimal effort.

- False Scarcity: Training programmes frequently utilise artificial scarcity tactics, claiming limited availability despite operating continuous enrolment.

Cautionary Tales: The Social Housing Group Case

The risks associated with rent-to-rent schemes are not merely theoretical. Prospective participants would be well-advised to consider the ongoing investigation into Social Housing Group, a prominent rent-to-rent operation currently facing allegations of substantial fraud. This case exemplifies the potential consequences when rent-to-rent schemes operate without proper governance and ethical considerations.

Guidance for Landlords Considering Rent-to-Rent Proposals

For property owners contemplating rent-to-rent arrangements, the following safeguards are essential:

Due Diligence on Operators

- Business Verification: Engage only with established businesses with demonstrable assets and sustainable income streams.

- Experience Assessment: Request evidence of the operator’s experience in property management, including references from previous landlords.

- Professional Credentials: Verify formal training and membership of recognised industry bodies such as the National Residential Landlords Association (NRLA), ARLA Propertymark, or the Association of Expert Landlords.

Ongoing Oversight

- Regular Inspections: Maintain a relationship with a reputable letting agent to conduct semi-annual inspections, ensuring compliance with regulations and appropriate property use.

- Contract Protections: Incorporate robust legal protections, including clear termination clauses and financial guarantees.

- Compliance Verification: For HMOs particularly, regularly verify that all statutory requirements are being met, including safety certifications and licensing conditions.

Advice for Those Tempted by Rent-to-Rent

For individuals considering entering the rent-to-rent market:

Critical Evaluation of Training Offerings

- Value Assessment: Compare the cost of proprietary training courses against established qualifications from recognised industry bodies.

- Testimonial Verification: Seek independently verifiable testimonials from successful practitioners who have no financial interest in promoting the training.

- Alternative Education: Consider formal property management qualifications that provide transferable skills and recognised credentials.

Realistic Business Planning

- Comprehensive Financial Modelling: Develop detailed financial projections accounting for void periods, maintenance costs, and potential regulatory changes.

- Legal Consultation: Seek independent legal advice regarding contractual obligations and regulatory compliance.

- Risk Mitigation Strategies: Establish contingency plans for various scenarios, including tenant non-payment, property reclamation by landlords, and unexpected maintenance requirements.

Conclusion: Beyond the Rent-to-Rent Mirage

The rent-to-rent model, whilst theoretically viable in specific circumstances, presents significant risks that are frequently understated by those with vested interests in promoting this approach. The reality is that sustainable success in property investment typically requires proper capitalisation, thorough education, and professional operation—qualities often lacking in rent-to-rent schemes marketed as low-barrier entry points to property entrepreneurship.

For those genuinely interested in property as a career or investment vehicle, the more sustainable path may involve:

- Developing professional expertise through recognised qualifications

- Building capital gradually through traditional employment or business

- Collaborating with established property professionals to gain experience

- Starting with modest, properly financed investments rather than precarious arrangements

The uncomfortable truth remains that in the rent-to-rent ecosystem, consistent profits are most reliably generated not by rent-to-renters themselves, but by those selling expensive courses promising financial liberation through this controversial business model. Prospective participants would be well-advised to approach such opportunities with healthy scepticism and thorough due diligence.

In the final analysis, there are few shortcuts to sustainable property wealth, and the rent-to-rent model—despite its alluring promises—frequently proves to be less a path to financial independence and more a costly lesson in the importance of proper capitalisation, professional education, and comprehensive risk assessment.