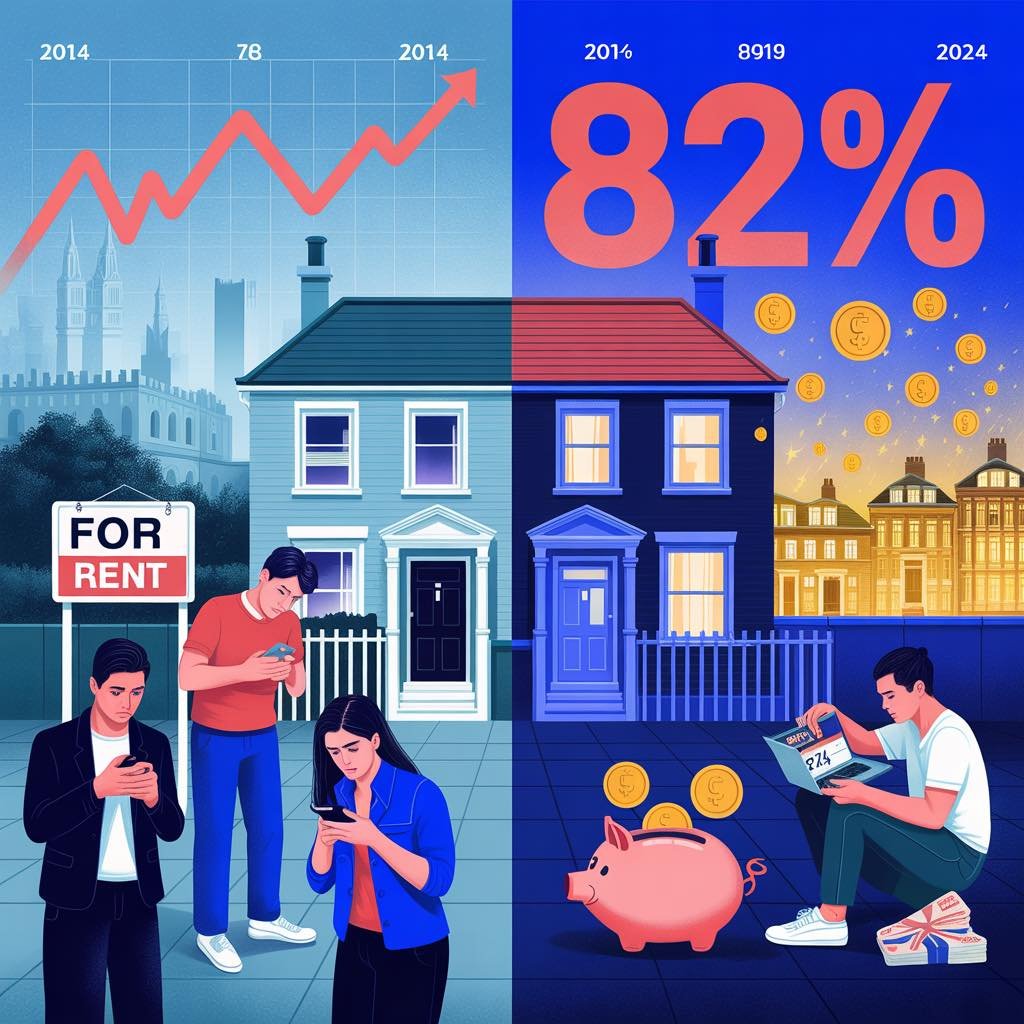

The UK rental market has experienced unprecedented inflation over the past decade, with average rents increasing by 82% from 2014 to 2024. Current rental inflation sits at 9.0% annually—the highest on record—while wage growth struggles to keep pace at just 5.2-5.8%. This represents a rental affordability crisis affecting nearly 5 million households across the country.

Explosive growth phase transforms rental market

The past decade divides into three distinct phases. From 2014-2019, rental growth remained moderate at 1-3% annually, with a record low of just 0.3% in January 2018. The pandemic transition period of 2020-2021 saw growth accelerate from 1.5% to over 2%. Then came the explosive growth phase of 2022-2024, with rental inflation peaking at 9.2% in March 2024—unprecedented levels not seen since the early 1990s.

Average monthly rents have skyrocketed from £692 in 2013 to £1,335 by 2024, meaning tenants now pay approximately £3,000 more per year compared to just 2021. This represents a 40% increase since 2020 while wages rose only 31% over the same period.

Regional variations reveal stark disparities

London remains the most expensive rental market with average monthly rents of £2,220-£2,698, experiencing 11.5% annual growth. However, the capital’s growth is now slowing due to affordability constraints, with some areas reaching unsustainable rent-to-income ratios.

Northern cities show more dramatic percentage increases. Newcastle leads with 9.0% annual growth and a 29% increase since 2020. Manchester averages £1,241 monthly with growth between 8.5-12.5%, while Edinburgh sits at £1,574 monthly with 7.9% growth. Surprisingly, Birmingham shows a 4% decline, making it one of the few major cities with falling rents.

The North-South divide is stark: London tenants pay £2,220 monthly compared to just £706 in the North East—a 3x difference that reflects broader economic inequalities.

Economic pressures compound rental inflation

Interest rate rises from 0.1% to 5.25% between 2021-2023 severely impacted the rental market. With 82% of buy-to-let mortgages being interest-only, landlords faced dramatically higher borrowing costs, leading to rent increases or property sales. Buy-to-let mortgage arrears more than doubled in Q4 2023.

The UK’s rental inflation significantly exceeds international peers. While the UK experiences 9-10% annual growth, the United States sees 3.4%, Canada 5.4%, and most European nations implement rent controls limiting increases to 3-4%. This places the UK among the world’s most expensive rental markets relative to income levels.

Affordability crisis reaches breaking point

UK tenants now spend 35.7% of take-home pay on rent, with some regions far exceeding healthy affordability ratios. London renters dedicate 41.5% of income to rent, while areas like Enfield demand 49.5% of income—well above the recommended 30% threshold.

Young people face the harshest burden. Those aged 16-24 spend 44.1% of gross income on rent, compared to 28.9% for 35-44 year-olds. Critically, 19.3% of UK tenants spend at least half their salary on rent, creating unsustainable financial pressure.

The private rental sector encompasses 18.8% of UK households—approximately 4.6 million households worth £54 billion annually. London has the highest concentration with 31% of households privately renting, reflecting the capital’s homeownership crisis.

Supply shortages drive relentless price pressure

Chronic undersupply remains the fundamental driver of rental inflation. Currently, 12 renters compete for each available property, down from peaks of 26 but still indicating severe market imbalance. Rental supply contracted by one-third over 18 months, with 35,000 more properties sold than bought by landlords in 2022.

Social housing decline exacerbates private rental pressure. The UK has 1.4 million fewer social housing units since 1980, with social housing now representing just 17% of households compared to 31% at its peak. This forces low-income households into an already strained private rental market.

New construction fails to meet demand. Despite government targets of 300,000 new homes annually, only 184,390 dwellings were completed in 2024—a 5.3% decrease from 2023. Housing starts remain 30.8% below pre-pandemic levels, creating a cumulative shortfall of 4.75 million homes.

Policy responses face implementation challenges

The government’s Renters’ Rights Bill 2024 promises significant changes including abolishing Section 21 “no-fault” evictions and implementing rent increase limits. However, energy efficiency requirements demanding EPC Rating C by 2030 threaten 2.9 million properties requiring £8,074 average upgrades. This has already led 18% of former rental properties to be sold rather than upgraded.

Housing benefit coverage continues declining. Only 2.5% of private rental properties remain affordable for housing benefit recipients, down from 12% in 2021-22. The average shortfall reaches £337 monthly for one-bedroom and £486 for three-bedroom properties.

Future outlook suggests continued pressure

Industry forecasts predict 3-4% rental growth for 2025—slower than recent peaks but still exceeding wage growth and general inflation. The Resolution Foundation projects 13% cumulative rental increases over the next three years versus 7.5% wage growth, suggesting the affordability crisis will deepen.

International comparisons highlight the UK’s unique position. While most developed economies implement rent controls or experience more moderate growth, the UK’s combination of supply constraints, high interest rates, and limited regulation creates exceptional rental pressure. Without significant policy intervention addressing supply shortages and affordability support, the rental crisis appears likely to persist throughout the decade.

Conclusion

The UK rental market has fundamentally transformed over the past decade, evolving from a period of moderate growth to an affordability crisis affecting millions. With rents rising nearly twice as fast as wages and supply shortages persisting, the private rental sector faces its greatest challenges in decades. The statistics reveal not just numbers but the lived reality of increasingly unaffordable housing for a growing share of the population, particularly young people and low-income households who find themselves priced out of both ownership and affordable rental options.